Regard current emblems. Emblems are a standard technique for shielding a company's standing and intellectual assets, so litigation for trademark infringement shouldn't be taken frivolously.

S firms are another option. Based on the SBA, firms “give the strongest security to its entrepreneurs from personalized legal responsibility, even so the cost to form a corporation is higher than other constructions.

Entonces, si usted compra algo y luego cambia de parecer, no podemos concederle un reembolso. En el caso de clientes con Servicio de Agente Registrado, primero deberá designar un nuevo agente registrado para su empresa. Si necesita ayuda para encontrar el formulario de gobierno correcto y cambiar su agente registrado en el estado, comuníquese con nuestro equipo de Atención al Cliente.

The amount of cash you have to start a whole new business will fluctuate, depending upon the state and sort of your business. A business strategy will help you estimate your bills And exactly how much dollars You will need to have your business off the ground and continue to keep it jogging.

An L3C is a comparatively uncommon "hybrid" concerning a nonprofit and for-profit LLC structure. This type of LLC is often created for a certain social objective but could also gain profits (in particular limitations).

Contain a business-form designator. Although the particular listing of approved abbreviations varies from state to state, all states call for that official business names consist of an indication from the business' construction.

Just one exception is definitely an LLC which has elected to get treated as an free LLC setup organization; in that scenario, the business must pay tax on its profits ahead of They may be handed along to your entrepreneurs, who are also subject to taxes on their share of these.

Constrained liability companies (LLCs) can defend your particular property and improve your business’s reliability. An LLC could be the simplest and many inexpensive legal business entity to form and sustain.

Following that, we create and file your article content of Corporation and an LLC operating agreement customized to your specs.

Shelling out statement filing service fees and possibly franchise taxes. Franchise taxes don’t refer to franchises like hamburger chains, but to taxes that some states impose on companies for the best to do business there.

A handful of forms of businesses normally can not be LLCs, for example banking companies and coverage companies. Look at your state’s necessities along with the federal tax restrictions for further more information. There are Exclusive rules for foreign LLCs.

Having said that, LLCs can choose to disregard the default classification and instead file as either an S corp or C corp, with Each and every acquiring its individual Rewards:

Your satisfaction is just a click away with Audit Protect! We provide two full several years of dedicated IRS audit representation and ten hrs of help from our team of skilled tax professionals.

A constrained liability company (LLC) can be a business structure that offers the good thing about constrained liability safety and versatile tax selections. Go through our step-by-step tutorial underneath to learn the way to start an LLC today.

Mason Gamble Then & Now!

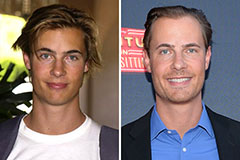

Mason Gamble Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!